- SAMPLE LETTER FOR HARDSHIP LOAN MODIFICATIONHARDSHIPSLETTER HOW TO

- SAMPLE LETTER FOR HARDSHIP LOAN MODIFICATIONHARDSHIPSLETTER FREE

- SAMPLE LETTER FOR HARDSHIP LOAN MODIFICATIONHARDSHIPSLETTER MAC

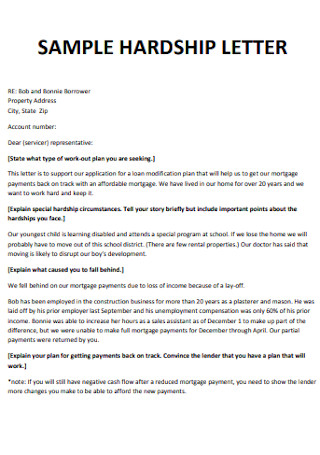

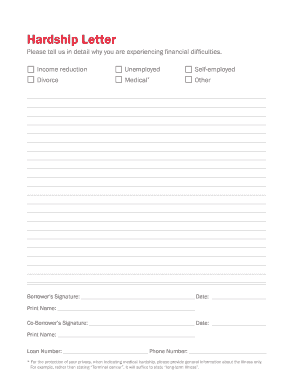

“I would include an explanation of what has changed in your financial situation that has made it difficult or impossible for you to make your monthly mortgage payments,” Sharga recommends. In your letter, you should affirm and attest that you are suffering a financial hardship caused by the COVID–19 emergency.

SAMPLE LETTER FOR HARDSHIP LOAN MODIFICATIONHARDSHIPSLETTER FREE

To get forbearance under this plan, you only need to state that you’re going through hardship. However, the CARES Act made it easier for homeowners to get help. Normal forbearance rules require you to “prove” your financial hardship by documenting your job loss or other issues.

SAMPLE LETTER FOR HARDSHIP LOAN MODIFICATIONHARDSHIPSLETTER HOW TO

How to request mortgage relief with a hardship letter To qualify, you must also be suffering a financial hardship caused by the coronavirus – such as a job loss, furlough, reduced hours at work, or costly medical treatment bills. If you need to postpone your mortgage payments, you must contact your loan servicer and request it. Note: Even if you qualify, you will NOT be automatically put under a forbearance plan. If you don’t know whether you have a government loan, ask your servicer (the company you make payments to).

SAMPLE LETTER FOR HARDSHIP LOAN MODIFICATIONHARDSHIPSLETTER MAC

To check if your loan is backed by Fannie Mae click here, or by Freddie Mac click here.

Rick Sharga, president and CEO of CJ Patrick Company, says there are three possible ways your deferred payment amounts can be paid back after the forbearance period ends: It means your mortgage payments are deferred or delayed until the end of the agreed–upon forbearance period.” –Suzanne Hollander, Real estate attorney It means your mortgage payments are deferred or delayed until the end of the agreed–upon forbearance period,” explains Suzanne Hollander, a real estate attorney and Florida International University senior instructor. “Forbearance doesn’t mean you don’t have to repay the postponed payments or that your debt is forgiven. At the end of that 180 day period, they can then request to extend this period for an extra 180 days – adding up to 12 months maximum.

The CARES Act lets borrowers request an initial forbearance period up to 180 days.

The CARES Act permits mortgage borrowers who are experiencing a COVID–19–related financial hardship to seek forbearance of their loan for a limited time (up to one year).įorbearance means the lender agrees to suspend your mortgage payments with no threat of foreclosure on your property. It’s important to understand what the CARES Act offers in the way of mortgage relief – and who’s eligible.

0 kommentar(er)

0 kommentar(er)